Main Estimates for 2011-12: They tell us very little about what Government Spending will be

The Main Estimates for 2011-12 were tabled on March 1, 2011. The press release claimed, “For the first time in over a decade, funding needed to sustain the federal government has decreased. The 2011-12 Main Estimates are over $10 billion lower than the Main Estimates for last year.”[1].

No one should be surprised by this decline and no one should make too big a deal of it. Final program spending for 2011-12 should be lower than 2010-11, due to the ending of the temporary measures under the Economic Action Plan. But will it be over $10 billion lower? The March 22nd budget may shed some light on government program spending for 2011-12, but we won’t know the final spending outcome until the audited financial results for 2011-12 are tabled in the fall of 2012.

So do the Main Estimates tell us anything useful about government spending in 2011-12? Not much really.

What are the Main Estimates?

Under the Financial Administration Act, no spending can be undertaken without approval by Parliament. Main Estimates are the means by which Parliament gives approval to government spending but for only one type of spending. There are two types of spending in the Main Estimates: “voted” expenditures requiring annual approval from Parliament and “statutory” expenditures for which legislation was previously approved setting out the specific terms and conditions under which payments can be made. In the Main Estimates, Parliament only considers “voted” expenditures for approval. The “statutory” expenditures are provided for information only. Statutory expenditures amount for about 60% of total Main Estimates.

Main Estimates for the upcoming fiscal year (e.g., 2011-12) are usually tabled on or before March 1st. The only exception is when Parliament is not in session. This gives the government interim authority to undertake spending on voted items, prior to official approval by Parliament. That approval is usually given in June, after examination by Parliamentary committees. If the government fails to table Main Estimates on or prior to March 1st, it cannot undertake spending on any of the voted items until Parliamentary approval is granted. This is why the government had to table Main Estimates on March 1st.

I

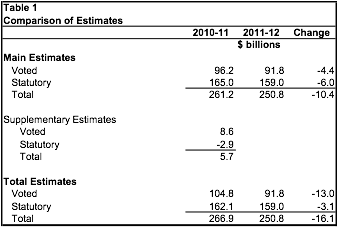

Decomposing the $10 billion Decline in the Main Estimates

The President of the Treasury Board brags about a $10.4 billion decline in spending in 2011-12, implying that this is the result of good stewardship over public spending. But of this decline, “voted” spending, the spending over which the government has the most discretion falls by only $4.4 billion (see Table 1) whereas “statutory spending declines by $6 billion. Furthermore, the decline in statutory spending was completely accounted for in the October 2010 Update. The Main Estimates for 2011-12 only incorporates the October 2010 Update projections for statutory programs – no new information was provided.

Furthermore, it is also important to understand that Main Estimates are not comprehensive or a complete accounting for all of the government’s spending intentions during the course of the upcoming fiscal year (e.g., 2011-12). If the budget is tabled after the Main Estimates, then new priorities identified in the budget will not be included in the Main Estimates. Normally, the government tables three “Supplementary” Estimates during the course of the fiscal year, requesting additional spending approval from Parliament. In fiscal year 2010-11, for example, the government requested an additional $8.6 billion for voted spending.

We would have expected a larger decline in voted spending. The Government’s Economic Action Plan primarily consisted of temporary spending initiatives for fiscal years 2009-10 and 2010-11. According to the Seventh Report to Canadians, about $14 billion of stimulus funding was earmarked for 2010-11, of which $12.8 billion is “voted” spending. Of this amount, only $1.5 billion is ongoing. All other things remaining equal, one would expect “voted” spending in 2011-12 to be about $11 billion. Yet, according to the Main Estimates for 2011-12, “voted” spending is only expected to be $4.4 billion lower. This all the more surprising given the restraint measures announced in the 2010 Budget

Comparing Spending in the Main Estimates And Spending in the budget has become like comparing apples and oranges.

Traditionally, the Main Estimates have usually been tabled after the Budget. The Budget would then provide the basis for the Main Estimates and the statutory spending estimates in the Main Estimates would be identical to those in the Budget. The Main Estimates would provide reconciliation between the Budget expenditure estimates for the upcoming fiscal year and the Main Estimates for the year.

However, three of the last five budgets have been tabled after the Main Estimates and this will occur again this year. This could make the Main Estimates for 2011-12 irrelevant as the 2011 Budget will contain revised estimates for the major statutory programs, as well as new spending initiatives.

The Budget provides a much more comprehensive view of government spending than the Main Estimates. First, the budget includes new spending that reflects government priorities that are not included in the Main Estimates. Second, the budget is on an accrual basis of accounting, recognizing liabilities when they are incurred not when they are actually paid. In contrast, the Main Estimates are on a cash basis of accounting, recognizing spending only when a transfer has been made or a service delivered. For example, the cash payment of $1.9 billion associated with the “implementation of the Harmonized Sales Tax” is included in the 2011-12 Main Estimates. Yet the full liability was recognized in the 2009-10 financial statements. As a result, the $1.9 billion will have no impact on program expenses and the deficit in 2011-12. Capital expenditures are also included on a cash basis in the Main Estimates but are accrued in the Budget. Third, the Budge presents expenses on a gross basis whereas spending is on a net basis in the Main Estimates. Fourth, the Budget makes an allowance for the fact that departments do not spend all of their appropriations. No such allowance is made in the Main Estimates.

The Auditor General, in her observations on the government’s financial statements, has urged the Treasury Board to implement accrual-based appropriations. She argues that accrual-based appropriations would provide Parliament with a consistent basis for control and approval over voted spending that is the same as the overall government financial plan”. To date, the government has yet to commit to an implementation date for adopting accrual appropriations or to explain why it would not be prudent to do so”.[2]

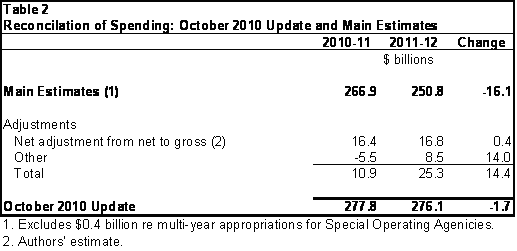

In the October 2010 Update, the government forecast program spending for 2010-11 at $277.8 billion, $10.9 billion higher than in the Estimates for 2010-11 (see Table 2). This difference increases to $25.3 billion for 2011-12, with virtually all of the difference due to the “other” category. No explanation was provided by the President of the Treasury Board. It would be helpful if the Minister of Finance and/or the President of the Treasury Board provided an explanation with the tabling of the March 22nd budget. The difference is extremely large and needs a full reconciliation. Otherwise, the credibility of the Main Estimates and/or Budget will come under attack.

Conclusion

The Main Estimates are one of the most confusing documents tabled by the government. They are on a completely different accounting basis than the audited financial statements and the spending forecasts in the Budget. They do not include all spending planned for the year. Parliament would be well served if the government adopted the recommendations of the Auditor General

Will spending decrease as claimed in the press release issued by the President of the Treasury Board? Most of the decline identified relates to revisions in statutory spending – revisions already identified last October. The decline in “voted” spending – the spending over which the government has the most discretion – declines by only $4.4 billion. With the ending of the stimulus spending, one would have expected a larger decline. And we know that voted spending would increase with the tabling of the Supplementary Estimates. Right now, the numbers just do not make sense.

[1] Treasury Board Secretariat: March 1, 2011

[2] Public Accounts of Canada 2009-10 Section 2.36

Add new comment