How Credible Is The October 2010 Fall Economic And Fiscal Update?

The Minister of Finance presented his Economic and Fiscal Update on October 12, 2010 in preparation for planning the 2011 budget, which showed a small surplus in 2015-16. Given a number of high profile international developments on the same day, the Update has received little public scrutiny. This note presents our assessment of the credibility of the latest Update.

Presentation Should Have Been to Finance Committee

The Minister of Finance presented his latest Update in a luncheon address to the Mississauga Chinese Business Association. We feel that such an important Update should have been presented to the House of Commons Standing Committee on Finance for their review and assessment. The Committee has been holding cross country pre-budget consultations to hear Canadians’ views on what should be included in the upcoming budget. A vital component in these consultations is the government’s updated economic and fiscal projections. However, once again, the government has undermined Parliament and the Committee.

It Should Have Included a More Detailed Assessment of the Prospects for the Global Economy and Their Implications for Budget planning

Simply saying, “we are the best in the G-7” is no longer adequate since the G-7 countries, and indeed the global economy, are not doing very well. The IMF, in its World Economic Outlook released last week, concluded that “the global recovery remains fragile” and the world economy is faced with a “recovery that is neither strong nor balanced and runs the risk of not being sustained.”

The reality is that advanced countries and emerging market countries must make difficult adjustments but there has been little progress to date.

In the United States, there is growing concern that the recovery may not be taking hold, as the economy struggles under the continuing burdens of balance sheet restructuring and extremely weak employment growth.

Research shows that after a recession, brought on by financial collapse, the length of time for the economy to return to potential can be as long as seven years. In some cases, there is even a permanent loss in potential output. This seems to be the growth track the U.S. economy is on, with forecast growth averaging around 2 per cent and the unemployment rate remaining stubbornly high, in the 9 to 10 per cent range. This implies a long period during which the economy will operate below its potential output.

The U.S. government is painfully aware of the political, social, and economic costs of such slow economic growth and stubbornly high unemployment. Talk of a “lost decade” in the U.S. is becoming commonplace.

But what to do? The government is confronting the worst fiscal situation in the U.S. with deficits forecast to remain in the 10 per cent range of GDP, and the debt burden to rise steadily higher, possibly reaching over 100 per cent within 15 years. The implication of this for bond yields remains troublesome to say the least. Nevertheless, there is talk in government about the need for more stimulus spending and a new round of “quantitative easing’ for monetary policy.

In Europe, the near collapse of the EURO during the Greek crisis cannot be seen as a minor “blip” soon to be forgotten. The EURO countries are confronted with the need for a major rebalancing, with the so-called peripheral European countries facing the need for major fiscal rebalancing and with it slower growth. Germany, the one strong economy, is facing pressure to strengthen domestic demand and to rely less on export led growth. This adjustment process will take years, not unlike the adjustment process in the U.S. economy.

Emerging market economies, at first glance, seem to be doing remarkably well, but with export markets weakening, it is unlikely that domestic demand will be able to step in to fill the gap. Stronger domestic demand growth in the emerging countries will not happen without major changes in domestic policy, particularly in China. This is now beginning to happen, but it will take many years to make the Chinese economy more reliant on domestic demand.

And finally and regrettably, one of the main causes of the financial meltdown, the exchange rate imbalances between the U.S. and China, still remains unresolved. The world can no longer rely on the American consumer to pull it along and not every country can be a net exporter. The responses of G-7 and G-20 Finance Ministers to current developments in exchange markets are ominously similar to those we heard many times before leading up to the financial crisis

Since the beginning of the year, the broadly accepted view now is that the global economic situation has deteriorated and that at best we can expect a modest, uneven and unpredictable global recovery.

The Canadian economy has done relatively well compared to other G-7 counties. The Canadian economy has in fact recovered to its pre-recession peak in output. Employment growth has been strong although much of this is part-time employment and the unemployment remains stubbornly stuck at around 8 percent.

One of the main reasons for this better performance was the elimination of the deficit in the 1990s, the resulting nine years of surplus and the paying down of debt for the first time in 50 years. But all this is history, with the government now running the largest deficit ever.

Further, it is unclear how and when this will stop. The recovery is very fragile, without any solid private sector footing. It has been running on government “steroids”, which will be withdrawn at the end of 2010-11, the strength of the housing sector and heavy personal consumption. The latter two will leave middle-income families with high debt burdens and exposed to higher interest rates.

This is certainly not desirable and definitely not sustainable. Eventually private sector investment will have to take over from the consumer and government, if the recovery is to strengthen. The Update did not provide an assessment of the factors that the Government believes are critical to getting the private sector to play a deeper and broader role in the recovery and how they will actually come about.

It should have included More Information on the Views of the Private Sector Economists and Their Forecasts in Order to Develop a Credible Medium-Term Fiscal Track

In preparation for the Fall Update, the Minister of Finance recently met behind closed doors with 14 private sector economists to discuss the future of the Canadian economy. Based on news reports, it would appear that the economists were unable to agree on where the economy is heading. There was a wide range of opinions expressed, but there were simply too many unknowns and too many uncertainties to reach a consensus.

The fact that economists can’t agree shouldn’t surprise anyone. But at this point in the economic recovery, the Minister of Finance should take their uncertainty and disagreements very seriously, especially when it comes to choosing the economic assumptions to be used for budget planning.

There is some acknowledgement in the Update of the variation in views on economic prospects by the private sector economists. However, much more information should have been provided on the forecasts of the private sector economists, not just the “average” forecast. We need to be given the range of forecasts and an explanation of why they differ. Taking the “average” of widely different views cannot be justified on statistical grounds when the biases are in one direction. Furthermore, although 15 forecasters may have provided their economic forecasts for the short term, there are only three or four forecasters who undertake detailed medium-term economic forecasts. This raises questions on the consistency between the short- and medium-term forecasts.

The Minister did make some marginal downward adjustments to the level of nominal gross domestic product (GDP), reducing the average private sector forecast by $10 billion in both 2011 and 2012 and by $5 billion in 2015. This had the effect of lowering revenues by $1.5 billion in both 2011-12 and 2012-13 and by $0.8 billion in 2015-16. This amounts to a “prudence” factors on total revenues of about 0.6 per cent in 2011-12 and only 0.3 per cent in 2015-16, hardly significant given the uncertainty and risks described above.

Short-term economic forecasting is difficult enough but uncertainty about economic prospects usually increases, not decreases, over time. So it is surprising that the adjustments to nominal GDP decline over the medium term rather than increase as one would expect. TD Economics’ view of the medium term is much more pessimistic, and in our view more credible, and its forecast of nominal GDP would have resulted in revenues being lower by $10 billion in 2015-16, with the result that there would still have been a deficit in 2015-16 rather than a surplus.

Given the risks and uncertainties, especially over the medium term the interest rate profile presented in the Update appears overly optimistic. Although rates to date are somewhat lower than forecast in the March 2010 Budget, the U.S. fiscal situation and developments among EURO countries could well put upward pressure on financial markets – a risk that is not account for in the Update.

We should also have been given the forecast of the Department of Finance and justification for not using it as the basis for budget planning instead of an “average”. The “average” has turned out wrong too many times. Moreover, the reason given for using the average of private sector forecast was not a recommendation of the 1994 Ernst and Young report ”Review of the Forecasting Accuracy and Methods of the Department of Finance. That report concluded that the Department of Finance had the best record for forecast accuracy but that the Government should consult more regularly with private sector economists. The only reason for using an “average” is to avoid political responsibility for the forecast, if it turns out wrong, and “to put the blame on others”(see separate paper on Time to Change the Budget Process).

It Should Have Included Finance’s view of Potential Economic Growth, the Output Gap, and How Long it will take to Eliminate this Gap

The Parliamentary Budget Office (PBO) estimates that the economy began to operate significantly below its potential in 2009. Surprisingly, the Department of Finance estimates that the economy began to operate below potential in 2008, notwithstanding statements by the Prime Minister and the Minister to the contrary.

Most important, the PBO and private sector economists are now predicting that Canada’s economic potential will average less than 2 per cent per year over the period to 2014 and beyond. This would represent a reduction of 1 per cent in potential output growth since the year 2000.

The reasons for this decline are twofold: first, the decline in the trend labor force growth, resulting from the aging of the population and a fall in the long-term employment rate; and second, continuing low productivity growth.

This will mean a decline in the growth of government revenues with obvious implications for budget planning. The PBO, and some private sector economists, including us, believe the deficit has a significant and growing structural component. This is due not only to the reduction in potential economic output but also to the mismatch between tax revenues and program expenses, given the significant reductions in taxes and increases in spending.

The PBO in a recent presentation to the House of Commons Standing Committee on Government Operations and Estimates stated that ‘Notwithstanding Canada’s relatively strong fiscal performance when compared to some other countries, parliamentarians are facing two large fiscal waves. First come large budgetary deficits caused by the economic downturn and the implementation of a deficit financed stimulus package. This short-term wave will be followed soon by growing costs for baby boom retirees drawing elderly benefits and health care services and weaker budgetary revenues due to declining growth in labor supply.” The Minister of Finance has for some time rejected this view without providing his own analysis, It is inconceivable that the Department has not done its own research on the structural deficit, as it does publicly provide estimates on an historical basis. The Update should have addressed this issue by providing analysis and projections of the structural deficit given its importance to budget planning.

It should have included a Status Report on the Government’s Search for Savings by Cutting Program Spending

The government has said it will never raise taxes to eliminate the deficit. Never mind that it is raising the employment insurance (EI) rate, which is a payroll tax. The government has also committed to excluding transfers to provinces and individuals from any spending cuts. Who knows how long this commitment will last given that the current funding agreements for both Canada Health Transfer and Social Health Transfer expire on March 31, 2014. For planning purposes, the Minister of Finance has assumed that the current legislated rates of growth will continue. How realistic is this in the current environment? Indeed the Minister of Finance seems much less committed to excluding transfers to the provinces from restraint than he was in the budget. Look for this commitment to soon disappear.

The reason is simple. The government has said that it could find all the expenditure savings it would need, if necessary, from remaining government programs. This will not happen. In the March 2010 Budget, departmental operating budgets for 2010-11 are to fund the 1.5-per-cent increase in annual wages for federal public administration. For both 2011-12 and 2012-13, departmental operating budgets are to be frozen at their 2010-11 levels to generate “efficiency savings”. The experience of the Program Review exercise in the mid-1990s clearly demonstrated that without the elimination of and/or significant cutbacks to existing programs, ongoing “efficiency savings” are not sustainable. Since this government will never raise taxes this puts the growth of transfers on the cutting block.

There was no status report on the expenditure savings.

How Credible is the Claim that Canada Will be Debt Free by 2015?

The Minister of Finance stated “that Canada’s total government fiscal situation – that of the federal, provincial-territorial and local governments combined – will be broadly balanced by 2015”. What he forgot to mention is that this will largely be due to the surpluses in the Canada and Quebec Pension Plans, not because of balance in the federal, provincial-territorial and local governments.

How Credible are the EI Assumptions?

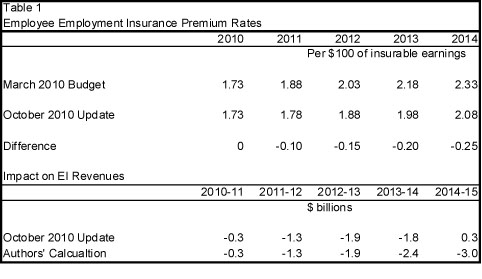

For 2011, the Minister of Finance rejected the recommendation of the Canada Employment Insurance Financing Board (CEIFB) to increase employment insurance (EI) premium rates by 15 cents (employee rate) but instead capped the increase to 5 cents. For future years, he indicated that the annual change would be capped at 10 cents rather than the current 15 cents legislated cap. This raises issues as to why the government created the CEIFB in the first place (subject of upcoming paper). This issue was also raised by the Auditor General in her opinion on the condensed financial statements.

In the Update, the Minister of Finance indicated that revenue loss would be $0.3 billion in 2010-11, $1.3 billion in 2011-12, $1.9 billion in 2012-13, and $1.8 billion in 2013-14, with a revenue gain of $0.3 billion in 2014-15. Without knowing what the EI premium rates assumptions were in the March 2010 Budget, it is impossible to assess the accuracy of these estimates. However, based on the forecasts presented in the March 2010 Budget and in an analysis done by the PBO, it appears that EI rates were assumed to increase by 15 cents per year throughout the forecast period. This would imply a revenue loss of $2.4 billion in 2013-14 rather than $1.8 billion and a revenue loss of $3.0 billion in 2014-15 rather than a revenue gain of $0.3 billion. Based on the Update’s projections for EI premiums and program expenses and our estimates of administrative and other costs charged to the EI Account, the account is still in deficit in 2014-15, which would preclude any reduction in the EI premium rate in 2014. More information is required in order to assess the credibility of the EI premium rate assumptions.

Other Unexplained Changes

The Update and the Annual Financial Report list a number of accounting changes and accrual adjustments affecting the outcome for 2009-10 and projections for the outer years. However, little or no details are provided on their impacts. For example, the reclassification of the Canadian Commercial Corporation is estimated to have increased program expenses by about $1.5 billion per year. The impact on “other revenues” is stated to be about the same. However, when one adjusts for the impact of the Canadian Commercial Corporations, there is a large shortfall from the March 2010 Budget projections, amounting to $3.2 billion in 2012-13, which is not adequately explained.

The same is true for direct program expenses, were transfer payments are $2 billion lower in 2014-15 than in the March 2010 Budget, after adjusting for the new policy measures. No reason is given.

The prime reason for the higher-than-expected deficit in 2009-10 and lower deficit in 2010-11 was attributed to a change in the timing in the recognition of the accrual for the transitional assistance payments to Ontario and British Columbia for the harmonization of their sales taxes with the GST. This change in timing should have been recognized well in advance of the finalizing of the 2009-10 financial statements and undermines the credibility of current fiscal information. From the time these agreements were signed, the Department of Finance should have recognized the risks and have been in ongoing consultations with the Office of the Auditor General. The importance of such discussions was one of the key recommendations of June 2005 report entitled Canadian Federal Fiscal Forecasting Processes and Systems by Dr. Tim O’Neill.

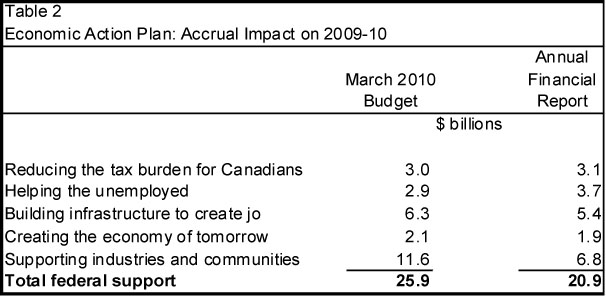

The Annual Financial Report presents a summary table of the fiscal impact of the measures under the Economic Action Plan. On an accrual basis, the fiscal impact is estimated at $21.0 billion for 2009-10. In the March 2010 Budget, the accrual impact for 2009-10 was estimated at $25.9 billion (see Table 2). There no reconciliation of this difference and how it impacts on the final outcome for 2009-10.

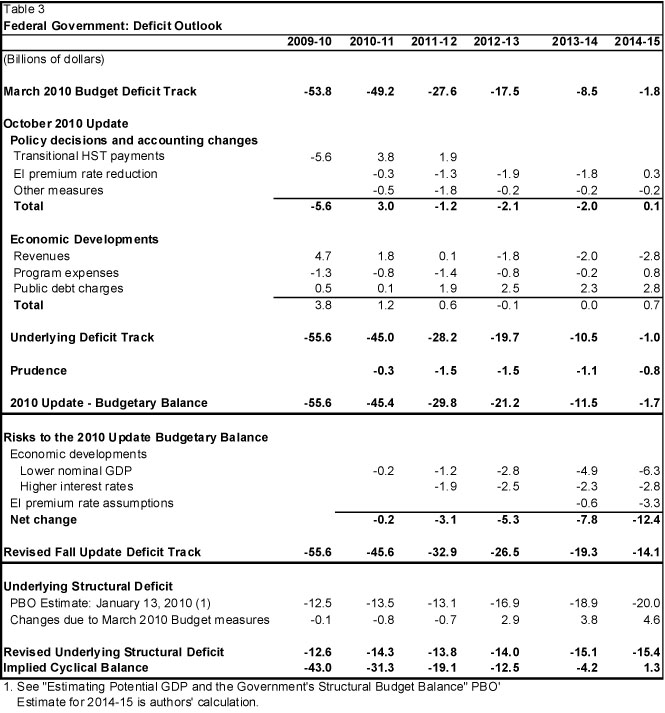

It should have included a credible Deficit Planning Track

The first panel of Table 3 summarizes the changes in the budgetary balance from the March 2010 Budget to the October 2010 Update as presented in the Update. The second panel makes adjustments for less than favourable economic developments to 2014 and for EI premium rate assumptions. The net impact of these adjustments is to increase the October 2010 Update deficit by $3.1 billion in 2011-12, rising to $12.4 billion in 2014-15. Under this scenario, a balanced budget would not be attained in 2015-16.

The third panel decomposes the revised budgetary balances into its structural and cyclically components. The structural deficit is based on PBO’s estimates, adjusted for policy decisions in the March 2010 Budget and October 2010 Update. The structural deficit is estimated at about $15 billion annually. By 2012-13 the structural deficit, or second wave as the PBO describes it , will begin to overtake the declining cyclical balance. It is not possible to eliminate a structural deficit through growth since it is not possible for an economy to continue to grow above it potential. Ultimately, a structural deficit can only be eliminated through higher revenues and/or cuts to program expenses.

Eventually both the Conservatives and Liberals are going to have to face this choice. Do you eliminate the structural deficit by downsizing the Federal government through the complete elimination of federal programs and restraining the growth in provincialtransfers. Alternatively, do you maintain, and perhaps even expand the role of the federal government through a combination of higher revenues and spending restraint?

Add new comment